Buying your first home is exhilarating—but without proper preparation, it can quickly become overwhelming. At Lyon Legal, we’ve helped hundreds of first-home buyers across Northern NSW navigate the conveyancing process successfully. This guide provides your essential step-by-step checklist, plus key insights into grants and schemes that could save you thousands.

Why This Checklist Matters

Statistics show:

-

42% of first-home buyers regret not understanding conveyancing better (ABS 2023)

-

1 in 5 NSW property purchases face delays due to avoidable conveyancing errors

-

Eligible buyers often miss out on $10,000+ in grants by not claiming correctly

Our checklist helps you:

✅ Avoid costly legal pitfalls

✅ Maximize your first-home benefits

✅ Move into your dream home stress-free

Pre-Purchase Essentials

1. Understand Your Budget (Including Hidden Costs)

Beyond the purchase price, factor in:

-

Conveyancing fees: $1,500-$2,500 (NSW average)

-

Stamp duty: Use the NSW Revenue Calculator

-

Building/pest inspections: $500-$1,000

-

Lender’s mortgage insurance (if deposit <20%)

Case Study: A Byron Bay buyer saved $32,000 using the First Home Buyer Assistance Scheme after we identified their eligibility.

2. Research Grants & Schemes

Key NSW Programs:

| Scheme | Potential Savings | Eligibility |

|---|---|---|

| First Home Buyer Assistance Scheme | $0 stamp duty (<$800k) | Must be Australian citizen |

| First Home Guarantee | 5% deposit (no LMI) | Income <$125k singles/$200k couples |

| Regional First Home Buyer Grant | $10,000 grant | New homes in regional NSW |

Action Step: Download our free grant eligibility guide .

Contract Exchange: Critical Checks

3. Contract Review (Non-Negotiables)

Your conveyancer should verify:

✔ Zoning and permitted uses (e.g., can you add a granny flat?)

✔ Easements (rights others have over the property)

✔ Special conditions (e.g., “subject to finance” clauses)

✔ Strata reports (for apartments – check levies and sinking funds)

Red Flag: We recently saved a Lismore client from buying a property with an undocumented sewer line easement.

4. Cooling-Off Period Strategy

-

Standard 5 business days for residential purchases

-

Can be waived with a 66W Certificate (requires lawyer approval)

-

Use this time for:

-

Final inspections

-

Finance confirmation

-

Reviewing strata reports

-

Between Exchange and Settlement

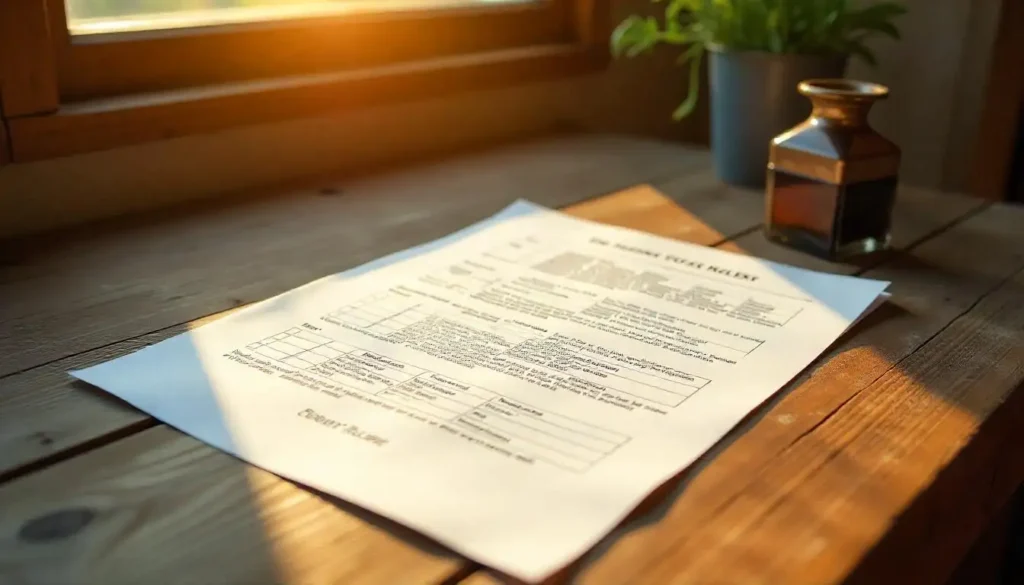

5. Document Preparation Timeline

| Task | Deadline |

|---|---|

| Pay deposit | Usually 10% within 7 days |

| Final mortgage approval | 3-4 weeks pre-settlement |

| Pre-settlement inspection | 1 week before settlement |

| Insurance commencement | From exchange date |

6. Property Searches You Need

-

Title search: Confirms ownership and restrictions

-

Council records: Check for approvals/notices

-

Road widening plans: Especially important for regional properties

-

Flood/bushfire maps: Critical in Northern NSW

Settlement Day: What to Expect

7. Final Checks Before Keys Are Yours

-

Verify all contract conditions are met

-

Confirm adjustments (rates, strata fees) are calculated

-

Ensure bank funds are ready for transfer

8. Post-Settlement Essentials

-

Update electoral roll and driver’s license

-

Notify utilities providers

-

Store all documents safely (you’ll need them for tax/CGT)

First-Home Buyer FAQ (Schema Optimized)

Q: How much does conveyancing cost for first-home buyers in NSW?

*A: Typically $1,500-$2,500. Some firms offer first-home buyer discounts.*

Q: Can I get stamp duty relief if I buy a $900k property?

A: Partial exemptions may apply – our grant guide explains thresholds.

Q: What if the building inspection finds problems?

A: You may negotiate repairs/price reduction before settlement.

Why Choose Lyon Legal?

✔ Northern NSW specialists (we know local council nuances)

✔ Fixed-fee packages tailored for first-home buyers

✔ Grant maximization – we ensure you claim all entitlements

Limited Offer: Free 30-minute conveyancing consultation for first-home buyers.

Call (02) 6722 4898

Email: conveyancing@lyonlegal.com.au

Key Takeaways

-

Research grants early – savings can exceed $30,000

-

Never skip inspections – future repairs cost more

-

Choose local expertise – NSW laws differ from other states

Next Step: Download our First Home Buyer Conveyancing Timeline