Estate and will planning is not just for the elderly or wealthy—it’s for anyone who wants to protect their loved ones, avoid unnecessary legal battles, and ensure that their wishes are clearly documented and respected. Without a legally valid will and a well-structured estate plan, families can face emotional stress, financial burdens, and even drawn-out disputes.

In this post, we’ll explore why proper estate planning and wills management is essential, what can go wrong without it, and how you can take steps to secure your legacy.

What Is Estate Planning?

Estate planning is the process of organising your financial and legal affairs to ensure that, after your death (or in the event of incapacity), your assets are distributed according to your wishes. It often includes:

-

Drafting a legally binding last will and testament

-

Creating a testamentary trust (if needed)

-

Appointing an executor of the estate

-

Setting up enduring powers of attorney and guardianship arrangements

-

Planning for potential tax implications

-

Preparing for the probate process

An effective estate plan provides clear direction, legal certainty, and peace of mind for you and your loved ones.

Why Estate Planning Matters

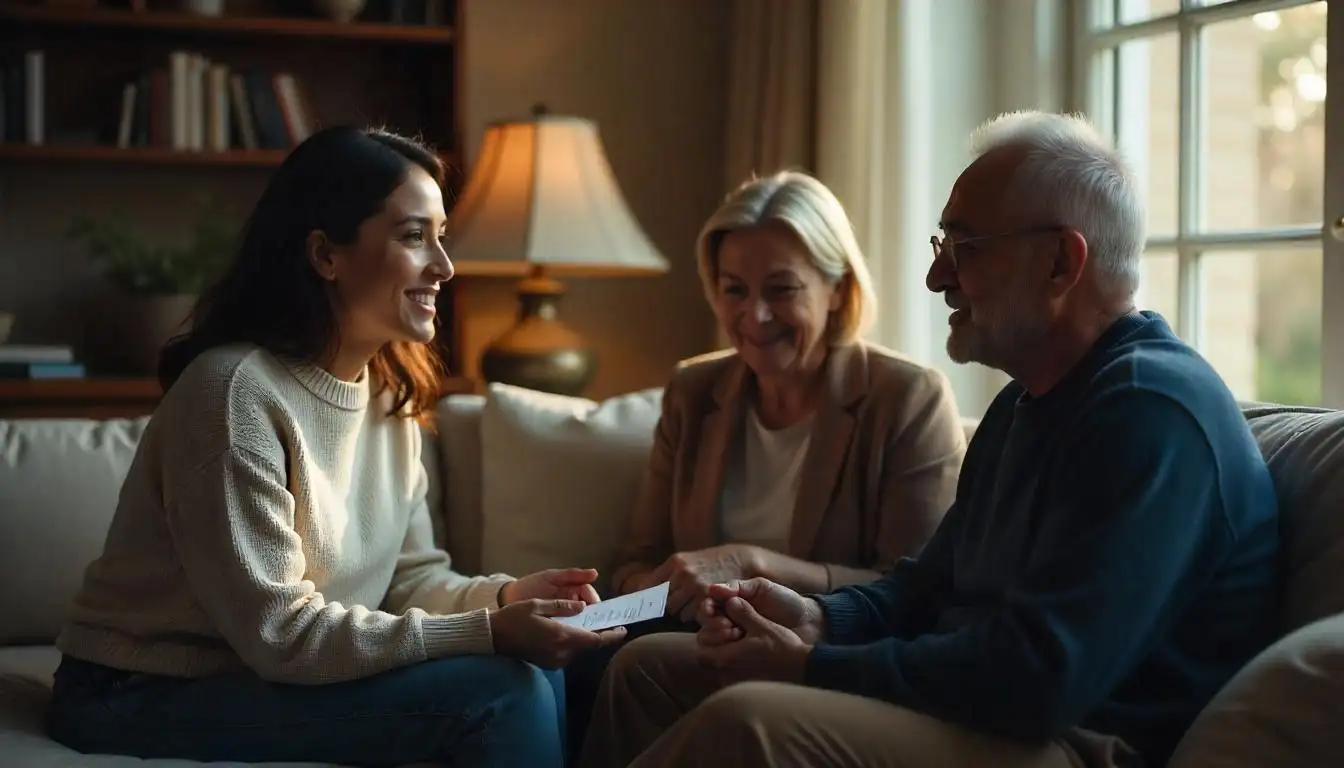

1. Avoid Family Disputes

One of the most common issues that arise after someone passes away is conflict among family members. Without a clear will, misunderstandings can occur regarding who inherits what. This can lead to:

-

Lengthy legal battles

-

Damaged family relationships

-

Disputes over property, finances, or guardianship of children

Having a valid will and clear estate plan minimises ambiguity and helps maintain family harmony.

2. Ensure Your Wishes Are Honoured

If you die intestate (without a valid will), state laws determine how your assets are distributed. This may not reflect your preferences.

By preparing a will, you can:

-

Decide who will receive specific assets

-

Name guardians for minor children

-

Appoint a trusted executor to manage your affairs

3. Protect Vulnerable Beneficiaries

If you have family members with disabilities, addictions, or financial challenges, a tailored estate plan allows you to set up special provisions, such as protective trusts or testamentary trusts, to manage their inheritance responsibly.

What Happens Without a Will in NSW?

In New South Wales, if you pass away without a valid will:

-

Your estate is subject to the intestacy rules under the Succession Act 2006 (NSW)

-

The court appoints an administrator to handle your estate

-

Assets are distributed in a predetermined order, often excluding non-blood relatives or stepchildren

-

You lose control over important decisions like guardianship for your children

This legal process can be costly and time-consuming for your family, and may not reflect your personal relationships or intentions.

Components of a Strong Estate Plan

1. The Will

Your will should outline:

-

Who inherits your property and assets

-

Who you appoint as executor

-

Who will care for your children (if under 18)

-

Funeral and burial preferences (optional)

A will must meet legal requirements to be valid in NSW, including being signed by you and witnessed by two people.

2. Enduring Power of Attorney (EPOA)

An EPOA allows someone to make financial and legal decisions on your behalf if you become incapacitated. It’s essential for managing:

-

Bank accounts

-

Real estate transactions

-

Legal contracts

3. Enduring Guardianship

This allows a trusted person to make health and lifestyle decisions if you’re unable to do so. This includes:

-

Medical treatments

-

Living arrangements

-

Access to support services

4. Advance Care Directive

Also known as a “living will,” this outlines your wishes regarding future healthcare decisions. It ensures your voice is heard even when you can’t communicate.

5. Trusts and Asset Protection

In some cases, setting up a family trust or testamentary trust can protect assets from creditors, taxation, or relationship breakdowns. Trusts can also help manage complex family dynamics, such as blended families or business ownership succession.

How to Get Started with Estate Planning

Step 1: Speak to a Qualified Solicitor

DIY wills may seem convenient, but they often lack legal validity or fail to cover key issues. An experienced solicitor can:

-

Draft a legally binding will

-

Offer estate structuring advice

-

Guide you through succession planning and probate

Step 2: Review Your Assets and Beneficiaries

Take stock of everything you own, including:

-

Real estate

-

Superannuation

-

Bank accounts

-

Shares and investments

-

Personal possessions

Ensure your superannuation death benefit nominations are up to date and binding.

Step 3: Update Your Plan Regularly

Major life events should trigger a review of your estate plan. These include:

-

Marriage or divorce

-

Birth of children or grandchildren

-

Death of a beneficiary or executor

-

Acquiring significant assets

Regular updates ensure your plan always reflects your current situation.

Common Misconceptions About Wills and Estate Planning

“I’m too young to need a will.”

Unfortunately, life is unpredictable. Anyone over 18 with assets or dependents should have a basic estate plan.

“Everything will go to my spouse automatically.”

That’s not always true, especially in blended families or with separate finances. Having a will ensures your spouse is legally recognised as a beneficiary.

“I don’t have enough assets to worry about it.”

Even modest estates can create complications. Your will can also handle guardianship, superannuation, and sentimental items.

Benefits of Proper Estate & Will Planning

✅ Reduces stress on loved ones during a difficult time

✅ Minimises the chance of disputes or contested wills

✅ Offers financial protection and tax efficiency

✅ Allows you to support charities or causes that matter to you

✅ Ensures minor children and vulnerable dependents are properly cared for

Final Thoughts: Plan Ahead to Avoid Regret

Estate planning is an act of care, foresight, and responsibility. Whether your estate is simple or complex, having a tailored, legally valid plan in place ensures that your family isn’t left with confusion, legal hurdles, or conflict.

Don’t wait until it’s too late—start the process today. A trusted legal advisor can help you understand your options and draft the right documents to protect what matters most.

Need Help with Estate Planning in NSW?

At Lyon Legal Services, we specialise in wills, estates, probate, and powers of attorney for individuals and families across New South Wales. Whether you’re just starting out or need to update an existing plan, we’re here to help you every step of the way.

Contact us today for a confidential consultation and start planning for peace of mind.